(Enrolling accounts via e-mail is now possible)

BPI recently announced that there will be changes in fees for online and mobile funds transfers starting July 1, 2019. The good news is, you can continue to enjoy these services for FREE.

Here are two ways to do so:

Let’s talk about them briefly, starting with the former.

ENROLL AN ACCOUNT

BPI has made it easier for you to enroll an account so you can continue to enjoy free funds transfers: all you have to do is to print, sign, and e-mail the enrollment form. Note that you can actually enroll up to 99 third-party accounts and billers (utility companies, schools, and other service providers) combined. Enrolling an account makes funds transfers easier as you will only have to select the enrolled account/biller whenever you transact.

There are two ways to enroll an account:

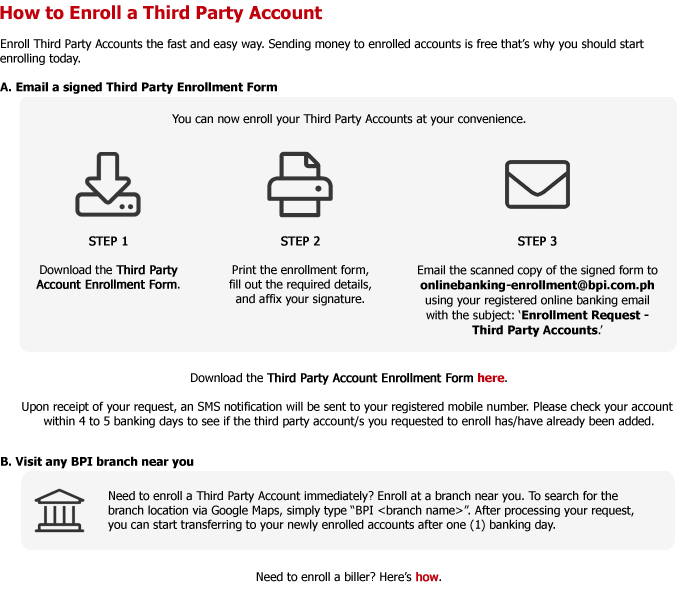

Option 1. Print, Sign, and E-mail

STEP 1: Visit bpi.com.ph. Select Personal, then Bank, then Services, then Transfer Funds, then Enroll Third Party Accounts. Download the Third Party Account Enrollment Form.

STEP 2: Print and sign the form.

STEP 3: E-mail the signed form to [email protected] using your registered online banking email.

Option 2. Visit any Branch

You can visit any BPI or BPI Family Savings Bank branch near you to enroll third party accounts.

The Print, Sign, and E-mail method involves less hassle but may entail a few days’ waiting time. However, if you need to enroll and transfer funds as soon as possible, then Option 2, which is a visit to the branch, is a better alternative as the enrolled account will reflect in your records on the next banking day.

TRANSFER VIA QR CODE

Another method you can use so you can transfer funds for free (for a limited time, by the way) is to use the QR code transfer feature. We have tested this feature in this article but we’ll post the steps here as well.

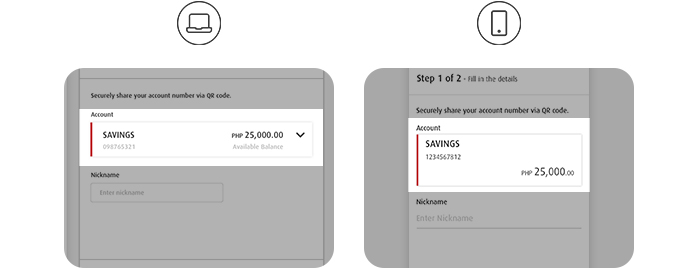

STEP 1: Log in to BPI Online or to the new BPI Mobile app and select “Other Services”, then “QR Generator”.

STEP 2: Select the account to generate a QR code.

STEP 3: Create a nickname for your QR Code. (The QR nickname can have a maximum of 10 alphanumeric characters.)

STEP 4: Select “Save to Device.” You can now start sending the QR code instead of giving your account number.

As a reminder, fund transfers to unenrolled third-party accounts will have a convenience fee of PHP 10USD 0.17INR 14EUR 0.16CNY 1 for every transaction in BPI Online and BPI Mobile app starting July 1. To know more about the new fees, check out our article here.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

Former BPI Customer says:

Total Nonsense, BPI get your act together you are misleading customers with “Free” *with Limitations from what used to be totally free with no need to pre-register, have you seen the queues lately in your Branch???? this would just make things worst isntead of promoting self service you are more promoting people to queue up on your branch…………. CIMB & ING offers transfers for free even when transferring to other banks

Justin says:

Ehem… Transferring to enrolled accounts and transfering via QR code is only free for the next few months. BPI has plans of imposing charges on those transactions as well.