Even before the pandemic started, digital banks have been existing to help Filipinos open their own bank accounts. Apart from removing the usual maintaining balance that major banks usually offer their savings account, these digital banks offer convenience to their customers. They offer perks such as online applications, cashless fund transfers, higher interest rates, and more. More of the transactions are all conducted within its mobile app, which also offers convenience to customers. We give you the list of some digital banks that you should try to enjoy cashless payments for 2021.

Author’s note: The following digital banks are a member of Philippine Deposit Insurance Corporation (PDIC) and regulated by the Bangko Sentral ng Pilipinas (BSP). Do note that these digital banks offer financial products and services processed through a digital platform and/or electronic channels with no physical branches.

Table of Contents

Popular for its paperless application and high-interest rates, ING is one of the Philippines’ l banks. It has a presence in more than 40 countries and recognized as a universal bank supervised by the Bangko Sentral ng Pilipinas (BSP). It’s also a member of the Philippine Deposit Insurance Corporation (PDIC). Customers may open a savings account through the ING app and submit proof of address and one government-issued ID. Do note that applicants should be 18 years old and older and Filipino citizens or residents of the Philippines. Currently, account holders may enjoy a high-interest rate of 2.5% p.a. for an available daily balance of PHP 20M or lower, earn an additional 1% gross p.a. for an available daily balance above PHP 20USD 0.34INR 29EUR 0.32CNY 2 million, no minimum maintaining balance, the online deposit of checks, limitless fund transfers per day, and free interbank fund transfer via PESONet and InstaPay from the ING app. Those with ING Savings Account may activate their Pay Account, which can be used for chargeless bills payment and online shopping through the virtual card. Until March 31, 2021, ING offers all first-time customers with an available daily balance of less than or up to PHP 20USD 0.34INR 29EUR 0.32CNY 2 million to their Savings Account an interest rate of 4% per annum for the first 4 months from their date of account opening.

CIMB Bank Philippines is an all-digital, mobile-first bank in the country with over 2 million customers. Commonly known for its affiliation with GCash’s GSave, the digital bank offers online applications through the app as fast as 10 minutes. Its identity verification solution uses machine learning, Artificial Intelligence, certified liveness detection, and face-based biometrics to ensure that person behind a digital transaction is who they say they are by matching a user’s live selfie with the photo shown on their government-issued ID. Customers may open either of the following accounts: Fast Account for a more simplified account opening process with minimal information provided and the expiration of 12 months, Fast Plus Account with a higher yearly interest rate of 0.75% p.a, and the high interest-bearing UpSave account. The first two accounts come with a debit card with a cumulative cash-in of PHP 5,000USD 85INR 7,223EUR 81CNY 621 and successful document verification within the app. Meanwhile, the UpSave Account has an interest rate of 3.0% per annum and doesn’t come with a debit card. Although cash-in and deposits from partner locations are free across the three types of accounts in CIMB, the Fast Plus and Fast Accounts allow users to withdraw from over 20,000+ Bancnet-affiliated ATMs nationwide. Also, both accounts do not require an initial deposit or minimum balance to earn interest. Currently, CIMB offers a 4% interest rate per annum to GSave and UpSave account holders with at least a balance of PHP 100,000USD 1,704INR 144,460EUR 1,623CNY 12,410 every qualifying month within February 28, 2021.

Download: iOS, Android, Huawei AppGallery

Although it is a subsidiary of EastWest Bank, KOMO is a fully digital bank with no physical branches. Its system gives customers full control over their account from account opening, fund transfers, bills payment, and card blocking. Its name is a shortened version of the Filipino phrase “kontrol mo ang pera mo“, giving simplified process and financial flexibility to its customers. Applicants may open their own digital savings account through the app. They must fill up a form and submit a clear copy of their valid government ID and selfie for identity verification. Coming in with a Visa debit card, which will be shipped later on to their registered address, account holders may earn an annual interest rate up to 3%. Daily interest earned updates daily before being credited to one’s account at the end of the month. It requires users to have a 6-digit password and sends OTP when opening their account through the mobile platform, offers free withdrawals and balance inquiry from EastWest Bank ATMs and Bancnet-affiliated ATMs (up to 4 times only for interbank withdrawals, initial charge will be refunded after 2 log-ins on the app), and has no minimum balance and initial deposit. It also offers free fund transfer via InstaPay, online bills payment, ATM cash withdrawal up to PHP 10,000USD 170INR 14,446EUR 162CNY 1,241 per transaction or PHP 20,000USD 341INR 28,892EUR 325CNY 2,482 per day, and online purchase up to PHP 10,000USD 170INR 14,446EUR 162CNY 1,241 per transaction or PHP 100,000USD 1,704INR 144,460EUR 1,623CNY 12,410 per day. Do note that the service is currently available to Filipino citizens.

UnionBank improves its banking services, allowing new customers to open a specific savings account that fits their digital needs. Although it has a physical branch, UnionBank offers specific banking products that only accept online applications through its online website and mobile apps. This includes the Lazada Debit Card for online shoppers, PlayEveryday savings account for those who like to earn rewards and points, GetGo Debit for frequent flyers, Personal Savings for earning interest, and Savings+ for getting free life insurance. Among the five savings account, only the Lazada Debit Card, PlayEveryday, Personal Savings, and GetGo Debit offer no maintaining balance. The first one comes with a virtual card, which the user may view in the app and offers up to two times cashback for every PHP 200USD 3INR 289EUR 3CNY 25 spent at Lazada. Meanwhile, the Personal Savings account offers a yearly interest rate of 0.10% and requires a minimum available deposit balance of PHP 10,000USD 170INR 14,446EUR 162CNY 1,241 to earn interest. Customers may secure online transactions with its two-factor authentication, online bill payment, deposit checks online, buy or send prepaid load, send and receive funds via QR Code, split bills, and more through its mobile app. The service, for now, is limited to Filipinos residing in the Philippines. UnionBank recently waived its interbank fees for fund transfer until March 31, 2021.

Download: iOS, Android, Huawei App Gallery

Backed by Asia United Bank, HelloMoney allows people to open a prepaid bank account with no monthly fees, maintaining balance, and initial deposit. Customers may open a HelloMoney account through the app other partner outlets, transfer funds to other bank accounts and e-wallets, accept QR code payments, manage ATM cards, and pay bills. There’s an option to avail and link an ATM card for those who want to withdraw through ATMs. There are three ways to cash-in on HelloMoney: over-the-counter deposits in any AUB Branch, adding money through Instapay from other Philippine banks, and fund transfer from other AUB or HelloMoney accounts. Monthly maximum cash-in transactions and maximum fund limit to save in a HelloMoney account are capped at PHP 200,000USD 3,408INR 288,920EUR 3,246CNY 24,820. Do note that some billers may charge a service fee for processing the transaction, and only those 18 years old and above are eligible to apply for a HelloMoney account. Account-holders are only allowed to link one HelloMoney ATM card at a time.

Maybank Philippines offers an online-only savings account through iSave. All forms and documentary requirements are submitted via the Maybank2U PH app. It doesn’t require an initial deposit or maintaining balance and earns a 0.25% yearly interest once you reach a balance of PHP 20,000USD 341INR 28,892EUR 325CNY 2,482. It also comes with an EMV enabled ATM card so you can withdraw your funds from any ATM in the Philippines for free. You can also withdraw in any Maybank ATM in Malaysia, Singapore, and Cambodia for free. Funding an iSave account is done via over-the-counter deposits in any Maybank branches, interbank fund transfers, GCash bank transfer, or deposit outlets such as 7-Eleven, RD Pawnshop, USSC, Tambunting Pawnshop, and more. Do note that an iSave account still needs to be verified by Maybank within 12 months upon opening. It has a maximum deposit limit of PHP 100,000USD 1,704INR 144,460EUR 1,623CNY 12,410, and restricts foreign remittances.

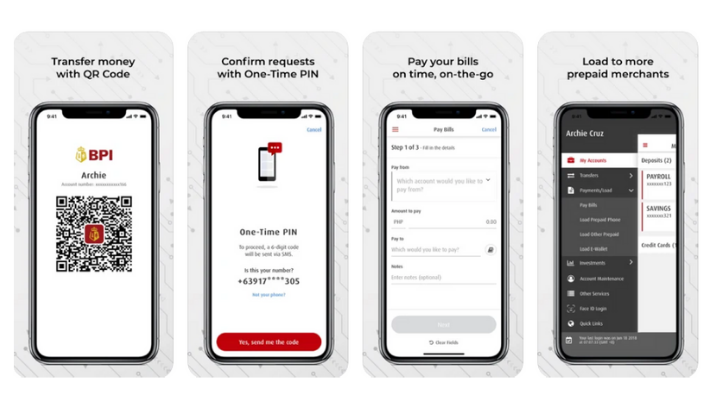

Another bank that is worth mentioning is BPI, which allows existing BPI account holders who are either enrolled and unenrolled to the mobile app to open savings accounts online. The initiative aims to provide a more convenient way to open a new saving account under BPI without going to physical branches. There are two saving accounts that BPI customers may open through the app: a regular savings account and a Maxi-Saver account. Although both come with debit cards, the former comes with a fixed yearly interest rate of 0.125% with an average balance of PHP 5,000USD 85INR 7,223EUR 81CNY 621 and a minimum deposit and monthly average maintaining balance of PHP 3,000USD 51INR 4,334EUR 49CNY 372. The Maxi-Saver, meanwhile, has a minimum deposit and average daily balance of PHP 50,000USD 852INR 72,230EUR 812CNY 6,205. Those with a balance amounting to PHP 50,000USD 852INR 72,230EUR 812CNY 6,205 to less than PHP 5USD 0.09INR 7EUR 0.08CNY 0.62 million earn 0.125% interest per annum. On the other hand, those with a balance of PHP 5USD 0.09INR 7EUR 0.08CNY 0.62 million have an annual interest rate of 0.25%. A bonus interest of 0.25% per year will be added if no withdrawal is made within a month on a Maxi-Saver account.

And there you have it, folks! We hope that we could provide you more options, especially now where cashless transactions are now the preferred payment option of most businesses. Have you tried any digital banks from our list? Let us know in the comment section down below!

Sources: ING FAQs, CIMB FAQs, KOMO Help page, UnionBank App, UnionBank Online, HelloMoney FAQs, Maybank iSave, BPI Opening of Account Online

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

gb says:

some of those interest rates are pathetic….BPI, 0.25%? They’ve got to be kidding !

joberta says:

BPI and GCASH are now charging transfer fees, which is really greedy on their part. Even bpi to bpi transfers really? this is corporate greed.