Transferring funds from one bank to another can be quite a handful to deal with. Not only does one have to deal with banks’ different policies, but one also has to deal with the exorbitant transfer fees. To lessen the stress, hassle, and fees, we’re here to introduce a middleman solution to users — virtual/digital wallets. Also referred to as e-wallets, these are services that allow people to do financial transactions online. Several digital wallets in the Philippines now have the feature to do bank transfers, letting individuals transfer their money with ease and without fees. Check them out!

First up is GCash. On GCash, customers can transfer to over 30 banks without any fees. Not only that, but GCash also allows users to transfer their funds to PayMaya as well. A user must first have a fully verified GCash account to be able to use the e-wallet’s features. To do bank transfers, a user just needs to pick a bank, enter the amount, enter the account name, and then the account number. They can also add an email address to receive a receipt of the transaction.

Here’s a list of banks partnered up with GCash:

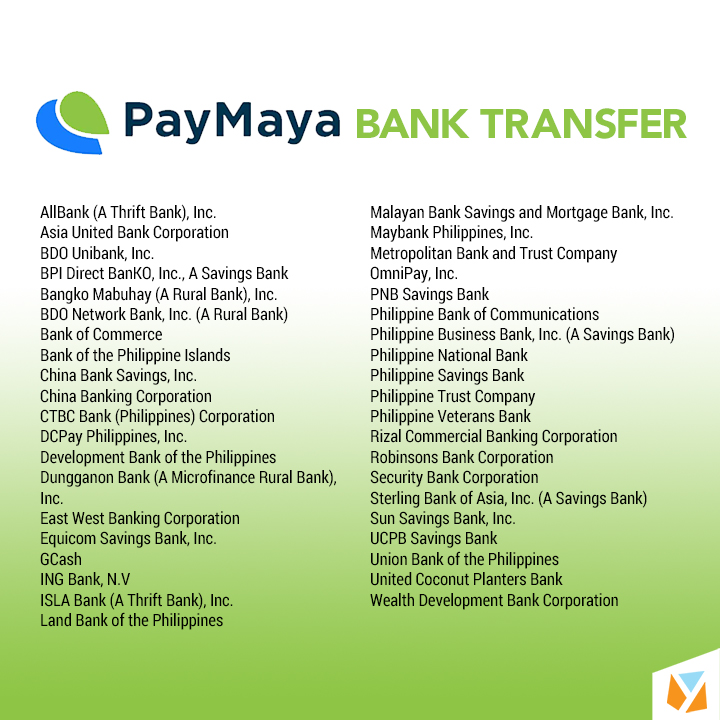

PayMaya’s bank transfer feature can be used once a user has a fully-verified and upgraded account. Partnered with around 40 banks, users can do transfers by selecting the “Bank Transfer” option on the home screen. From there, they can select a partner bank from the list, input the amount they want to transfer, input the recipient details, and hit ‘send’ after confirming the transaction details. PayMaya will then send a confirmation message via SMS.

Here’s a list of banks partnered up with PayMaya:

Individuals may also do bank transfers via Coins.PH e-wallet. Several of the banks partnered up with Coins.PH can do transfers instantly, while some require a 24-hour window time before the fund transfer is processed. The transfer process is also different for several of Coins.PH’s partner banks.

Here’s a list of banks partnered up with Coins.PH:

Grab’s e-wallet, GrabPay, now has a bank transfer feature. Once a user’s GrabPay account has been completely verified, they may now use the e-wallet’s funds transfer feature. To do so, users can click on Transfer, then select the ‘Send to Bank Account’ option. Afterward, they can enter the amount they wish to transfer, add the recipient’s full name, bank, and account number. Once they confirm the details, all they need to do is tap ‘Confirm’ and they will then receive their funds within 24 to 48 hours. GrabPay notes that a minimum amount of PHP 100USD 2INR 144EUR 2CNY 12 is needed to transfer funds. Customers can also transfer a maximum amount of PHP 500,000USD 8,520INR 722,300EUR 8,115CNY 62,050.

Here’s a list of banks partnered up with GrabPay:

Another option to do transfers is via the CIMB Bank app. Through CIMB, users have the option of transferring via Dragonpay or via PESONet. Dragonpay fund transfers have a service fee, depending on the bank, while transfers through PESONet have no charge.

Here’s a list of banks partnered up with CIMB:

ING is an all-digital bank that offers all its financial services through the ING app. Opening an account with ING allows individuals to do mobile check deposits and transfer funds to other banks. ING uses PESONet and InstaPay to transfer funds from its app to other banks without fees. Transferring funds before 3:30 PM will be received on the same day, while any transfers made after the cut-off time will be processed the next banking day.

Here’s a list of banks partnered up with ING:

And there you have it! What you need to do now is enroll your debit cards to these e-wallets and make the transfer. Some of these e-wallets even allow you to transfer funds to other e-wallets so you can transfer to other bank accounts they support. Basically it’s Bank Account –> e-Wallet –> Bank Account. It adds another step in the process, but hey, it’s better than incurring transfer fees or having to go to your local branch.

Got some e-wallet tips you can share with us? Let us know in the comments below.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

Blue says:

I always do this using GCash, saves me a lot of service charges hehe… I just need to fund my GCash via BPI which also has no service charge.

Jake says:

As far as I can remember, there’s a fee with Paymaya and Coins.ph. Does this mean they are doing it for free like GCash?

Ren says:

This article should be updated because there’s a ₱15 fee for transfers with GCash. I think PayMaya too. Idk with the others.