Let’s face it. Trips to the bank are never really any fun. You have to walk or commute, then fill out deposit slips, take a number, and wait in line for an hour – or thirty minutes, if you’re lucky. And, sometimes, when you have the unfortunate luck to enter a bank at peak hours with long lines. Luckily, with technology innovating at every turn, we now have a painless solution for those long waiting games at the bank, specifically EFTs like InstaPay and PESONet.

EFT or Electronic Fund Transfer lets you effortlessly transfer money to another bank or e-wallet (i.e. GCash, PayMaya, and Coins.ph) from the comfort of your smartphone. And the best part? All you need is an online banking account or e-wallet, a smartphone or computer, and a reliable internet connection – all of which are probably already within your fingertips’ reach.

Table of Contents

Electronic Fund Transfer (EFT) are services that allow users to transfer and receive money digitally or electronically – as long as both the payor and payee’s accounts are on the same EFT network. Essentially, you can think of EFT as a middleman between two different banks. They handle and facilitate the transfer and movement of funds from one account to another, so the transactions are done in a direct line. As for transaction fees, they are either handed out or handled by the bank or e-wallet of use.

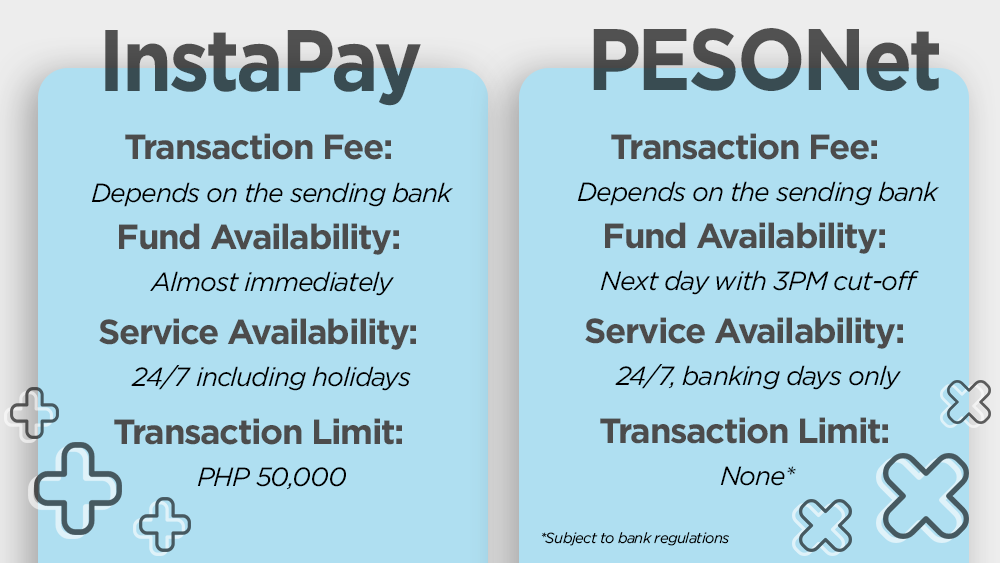

There are two major players in the EFT field in the Philippines: Instapay and PESONet. While the two may seem similar at first glance, they differ widely in transaction fees, fund transfer time, availability, and so much more. So, which should you choose for your next online bank-to-bank transfer?

InstaPay is an EFT regulated by the Bangko Sentral ng Pilipinas and launched under National Retail Payment System (NPRS). Its main mission is to provide a safe, affordable, and efficient retail payment system for all Filipinos.

Through InstaPay, users can send and receive funds between accounts linked to InstaPay, BSP-supervised banks, and partnered e-money issuers such as Gcash and Coins.ph. It is available for fund transfer 24/7 – even on holidays and weekends. And, all transfers and monetary movements are processed in real-time and recipients can expect funds to enter their accounts almost instantaneously.

InstaPay’s real-time processing is great for those who are issuing transfers that are urgent and time-critical. However, it is significant to note that fund transfers are limited to PHP 50,000 per transaction, and transaction fees are dictated by the bank and are charged to the sender’s account.

Pros:

• Real-time transfers

• Receive fund transfers in seconds

• Best used for urgent and time-sensitive transactions

• Available 24/7 even during weekends and holidays

Cons:

• PHP 50,000 limit per transaction

PESONet stands for Philippine EFT System and Operations Network and is under the same BSP-regulated NRPS program as InstaPay. In essence, PESONet was created to allow high-volume transfers of Peso funds on a digital scale. This includes salaries, invoice payments, large-scale recurring payments, and so on.

Because of the large-scale fund transfer, PESONet adheres to bulk processing at batch intervals with multiple settlements and clearing cycles within the day. This means that transfers are cleared, sent, and received in 1-2 days. To meet the next day cut-off, users must transfer funds on a working bank day before 3:00 PM. Failure to do so will mean your fund transfer will be processed on the next working day. And, in terms of the transaction fees, they adopt the same method of InstaPay wherein transaction fees are determined by the sending bank or e-money issuer and paid by the payor.

As for transaction limits, PESONet allows for unlimited amounts of fund transfer, which makes it best for company payrolls. However, banks may set maximum transfer limits, depending on the situation.

Pros:

• Transfer money without monetary transaction limit (varies depending on the bank and e-wallet)

• Best used for large-scale transactions such as salary and invoice payments

Cons:

• Transfers are not made real-time. 1-2 days leeway is needed.

• Not ideal for real-time transactions

• Only available on working bank days

InstaPay and PESONet are both great and reliable options for fund transfer, especially when you put them against the long lines of physical banks. However, deciding on which one to use boils down to a few factors including transaction fees, fund reflection, availability, and so on.

If you’re planning on transferring large amounts upwards of PHP 50,000, then you should probably opt for an institution that uses PESONet. While it may take longer for funds to reflect and a daily 3:00 PM cut-off must be met, sending large amounts is only possible through this EFT as InstaPay will often hold a limit of PHP 50,000 each day or each transaction.

However, you do have to keep in mind that some partnering banks on the PESONet network might set some fund transfer restrictions. For example, Metrobank has a daily PHP 200,000 maximum fund transfer limit. To ease restrictions, you have to contact your bank to send more than the daily limit.

On the other hand, InstaPay is an invaluable option for those that need to transfer or allocate funds in real-time. In fact, your recipient can expect funds to reflect almost instantaneously – if not a few minutes, depending on how busy the server is.

While you may be restricted to daily fund transfer limits (downwards of PHP 50,000), InstaPay is perfect for small and urgent transactions. While PESONet is ideal for sizable fund transfers that are not time-sensitive.

EFTs are a great way to avoid long bank lines and maintain social distancing. However, on the topics of which is better between InstaPay and PESONet, well, it really boils down to preference and needs. It’s also good to have multiple bank accounts or e-wallets that use InstaPay and PESONet. Are you sending an ample amount of money that is not confined to time restrictions? Go for PESONet. Otherwise, InstaPay is your go-to for real-time processing and fund reflection.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020