Tonik has officially launched in the Philippines as the market’s first neobank. It operates on the basis of its own bank license issued by the Bangko Sentral ng Pilipinas (BSP), providing deposit, loan, payment, and card products to consumers through a digital banking platform. What else do you need to know about this neobank? Read on to know more.

Table of Contents

Tonik is a digital-only bank that was recently launched in the country. Tonik Financial Pte Ltd is based in Singapore and focuses on product development and technology integration for its digital banking platform. Tonik’s banking operations in the Philippines are conducted by its local subsidiary Tonik Digital Bank Inc, regulated by Bangko Sentral ng Pilipinas as a rural bank.

As mentioned, Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP). The money is insured by the Philippine Deposit Insurance Corporation (PDIC) up to a maximum of PHP 500,000 per depositor. This implies that all the users’ money with Tonik in their Savings Account, Stashes, and Time Deposit are insured up to PHP 500,000 per depositor by PDIC.

Tonik’s cloud-based solution is powered by global financial technology leaders Mastercard, Finastra, and Amazon Web Services. As per Tonik, it is a highly secure digital banking platform that guarantees customer transactions’ safety and security. Check out Tonik’s professed safety and security features:

• It is geared with protection against malware, ensuring customer data safety and privacy against any type of breach.

• User account security is protected against fraud by the DAON server-based face check security feature.

• It secures access to the user’s Tonik account by using Face ID or Touch ID.

• It guarantees that no one can access a customer’s account by fabricating his identity if the account owner’s mobile phone is lost or stolen, even if the face ID is changed.

• Passwords are safeguarded from the moment of their creation through RCA asymmetric encryption of account holders’ One-Time Pins and passwords. The encryption level utilized for this feature is the same as that used by intelligence agencies and the military.

• Customer data is stored safely in the Amazon cloud with Advanced Cloud Security provided by AWSshield that effectively eliminates external threats like cyberattacks and data theft.

• 256-bit encryption protection puts all transactions through secure channels that cannot be intercepted. Their security operations center monitors all customer-related activities for any possible external threats.

Any Filipino who is at least 18 years old, residing in the Philippines, has a valid Philippine mobile number and email address, and not a person subject to United States’ FATCA can apply for a Tonik account.

The Tonik app is now available for download for Android 11 and iOS devices. It supports the minimum software system of iOS 10.0.0 for iPhone users and Android OS 5.0.0 for android users. The user’s phone needs to have a front-facing camera. It is also recommended that the phone must have at least 3GB of RAM.

Opening a Tonik account can be done as quickly as 5 minutes. Follow the steps below.

1. Download and install the Tonik app.

2. Enter your mobile number.

3. Read and agree to comply with Tonik’s Terms & Conditions and Data Privacy Statement.

4. Input OTP sent to your mobile number.

5. Do a selfie registration.

6. Select ID type or choose to do this later.

7. If you select your ID type, upload a picture of your ID, and confirm your ID particulars.

8. Enter your personal particular.

9. Enter your employment status.

10. Enter your email and mother’s full maiden name.

11. Provide your signature by signing on screen.

12. Create your application password. Finally, your account is ready!

Do note that if you do not upload your ID during your registration process, your account will have 12 months validity with a maximum balance of PHP 50,000. You can increase your balance limit and remove the validity requirement when you upload your ID after registration. The accepted IDs include the Philippine passport, Philippine Driver’s License, Unified Multipurpose ID (UMID), Social Security System (SSS), Professional Identification Card (PRC ID), and Firearms ID.

The app’s KYC check uses AI to identify your ID’s details such as ID number, name, and date of birth, so make sure to take a clear photo of your ID, preferably in a bright environment. In my first attempt to register, the AI got one of the letters in my name wrong. Although you can manually input your name in Step 8, it will cross-check the info you typed to the info it got on Step 7. If there’s a difference, your registration will not proceed, even if it’s just a single letter. We asked Tonik’s customer service via chat on what to do, and the advice is to delete and reinstall the app to start over. So, I hope that the AI will get your details right next time.

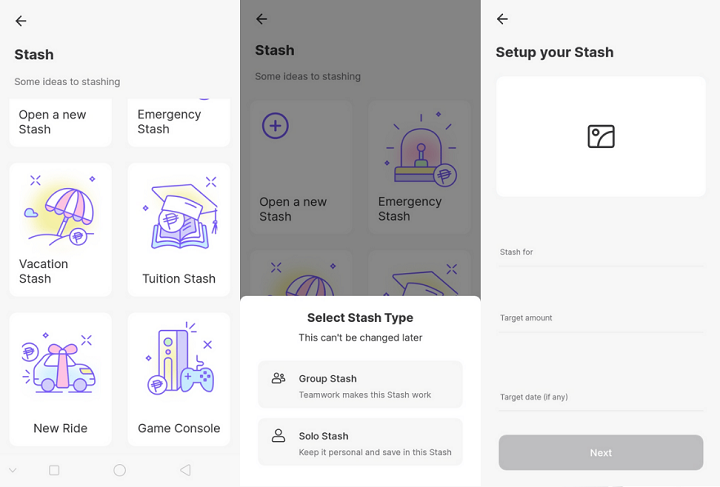

A Tonik account does not have a minimum balance requirement. Plus, there are also no dormancy fees, minimum deposits, and account closure fees. Currently, Tonik allows users to open up to five Solo and Group Stashes and up to five Time Deposit accounts. Further, Tonik offers deposit interest rates of up to 6% per annum, free Tonik to Tonik transfers, as well as free transfers to other banks.

Tonik’s Stash works as the users’ separate savings pocket. With Stash, users have the option to save money solo or by a group. Solo Stash has 4% interest per annum, while Group Stash has as much as 4.5% interest per annum. The stash can also be identified with purpose, target amount, and target date (if any). What makes it more fun is that users can also add a photo of their Stash for added customization.

Moreover, users may also take advantage of up to 6% annual interest for Time Deposit accounts. A time deposit is similar to a savings account, but it earns higher interest over time. Users may start from PHP 5,000 to PHP 500,000 and 6 months to 24 months. The app also has a calculator to assist users with their preferred investments and earnings from interest. Tonik, nonetheless, lets users withdraw their money anytime with no penalties and hidden charges. In such instances, Tonik lets users get 1% interest instead.

Upon onboarding, the customer is issued a virtual Mastercard debit card that can be used for various e-merchants. The free Virtual Debit Card enables users to shop via e-commerce platforms, pay bills, and make other transactions online. The app says that a physical debit card is coming soon.

What are the top-up options?

What are the top-up options?

Tonik account can be easily topped up in various ways, including top-up options through Debit cards, over-the-counter, and online. Check out the details below.

• Debit card via Visa, Mastercard, or JCB – transaction limits are based on the limit at the card-issuing bank

• Over-the-counter

• Online

What’s more, users may send or transfer money to other Tonik users (via mobile number or Tonik account number) or bank transfer via Instapay or GCash with no transaction fees. Over-the-counter transfers have a PHP 50 transaction fee in Cebuana and MLhuillier.

Tonik’s product offers will soon be expanded to include a physical debit card or take out an all-digital consumer loan.

Users may reach one of Tonik’s customer service agents via any of the following channels:

• In-app chat

• Tonik Digital Bank Viber chat (+632 5322 2645)

• Customer Service email at customercare@tonikbank.com

• Customer Service Hotline at (02) 5322 2645

That wraps it up! In case you haven’t found the answer to your questions yet and wanna know more, visit the official Tonik website 22.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

joel says:

how long the maturity date, or is it per month?

Demi says:

Hi thank you for this post. I’d just like to ask. Is your solo stash withdrawal anytime too? Thank you!:)

Bem says:

Yes, it is.

Rose Ann Capisonda says:

Hi how can i deposit to my account?

Bem says:

You can deposit via 7/11, ML, Cebuana, Unionbank, Gcash, coins. Ph and other banks or digital banks.

Raul A. says:

how much the maximum amount can be deposited to my account per day or week even months ?

Mae says:

How do you delete your account?

Jason Thomas says:

I lost my money to them few months ago in a bitcoin investment. I lost over $5,000, they denied my withdrawal request and and also left it pending. I reached out to them and they never responded back to my emails and calls. They eventually locked me out of my account. I had to reach out to a recovery expert (KONTACTTHEALIENDELTA @ GMAIL DOT COM) to help me recover all my money back. Thankfully I have gotten my money back.

Darwin says:

Hello. I just made my first deposit to my solo stash. Is the interest also given every end of the month?