The Bureau of Internal Revenue (BIR) today released a memorandum regarding taxation of any income received by social media influencers. This was released after the BIR has received numerous reports about huge income derived from social media.

The Bureau of Internal Revenue (BIR) has been receiving reports that certain social media influencers have not been paying their income taxes despite earning huge income from the different social media platforms. There are also reports that they are not registered with the BIR or are registered under different tax types or line of business but are also not declaring their earnings from social media platforms for tax purposes. Whatever may be the reasons, it is now the most opportune time to discuss the tax obligations of these social media influencers.

Last year, the BIR also called our Online Sellers to register their businesses with the bureau and gave them until July 31, 2020 to comply. The following week, the BIR also reminded bloggers, filmmakers, content creators earning from digital ads to register as a business entity.

This new memo, dated August 16, 2021, is a reminder to all BIR officers and clarify the proper taxation for social media influencers.

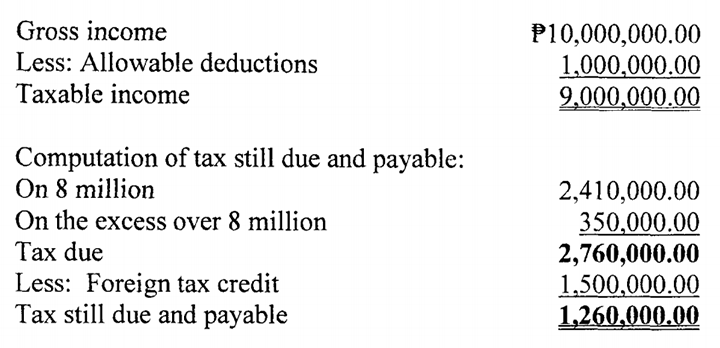

In the 10-page memo, the bureau identified possible sources of income by influencers (mostly vloggers/YouTubers) as well as provided some sample computations of how much of their income is taxable.

The memo is also encouraging tax officers to “conduct a full-blown tax investigation against social media influencers residing and/or registered within their respective jurisdictions.”

In short, we might be hearing tax evasion cases filed against big social media influencers that have not registered with the BIR or remitted their proper taxes.

You can read the full memo from the BIR here.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

Pakbir says:

Lahat nlang gagatasan….. pero cla sarap buhay. 20% remit sa gobyerno. 80% sa bulsa nila. Come on pinas. Bulag bulagan nb tayo s mga gunagawa ng bir ever since