GoTyme Bank users’ FREE deposits via linked bank accounts are down to two per month starting November 15.

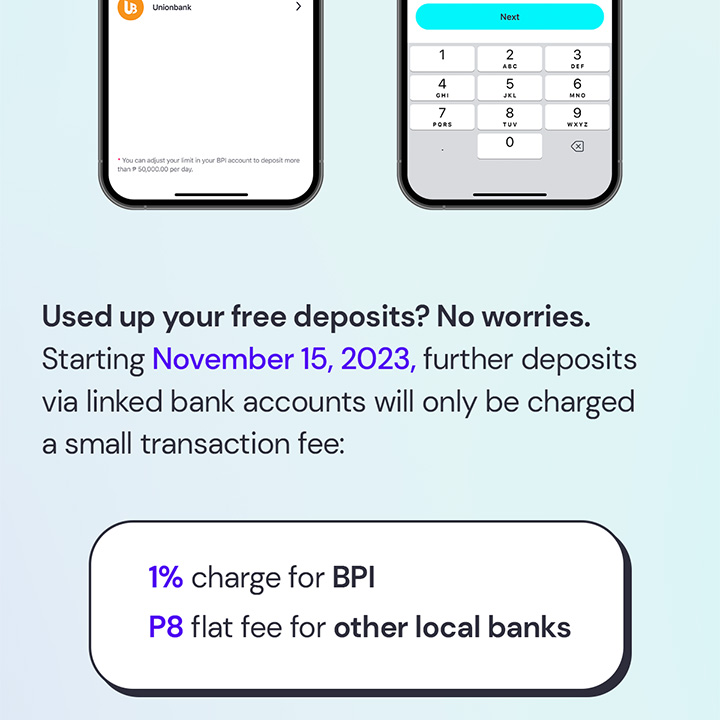

In an email advisory, dated November 4, the Gokongwei-backed digital bank says once all free deposits are used up, further deposits via linked bank accounts are charged with a ‘small’ transaction fee:

Hence, for example, if a user deposits from BPI for an amount of PHP 10,000USD 170INR 14,446EUR 162CNY 1,241, the transaction charge of 1% will be PHP 100USD 2INR 144EUR 2CNY 12.

As of writing until the said date, there is no cap on free deposits on any linked bank accounts.

A turnaround for BPI users is to send directly in-app via InstaPay or PESOnet to get around the 1% fee with as low as PHP 25USD 0.43INR 36EUR 0.41CNY 3 charge.

Last month, GCash implemented a PHP 5USD 0.09INR 7EUR 0.08CNY 0.62 cash-in fee for BPI and UnionBank linked accounts. One of the most popular e-wallet says that this is “due to increasing costs”.

Only time would tell if the other popular digital bank/ e-wallet, Maya, will follow suit of these deposit fees.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020