The digital economy in the Philippines is currently in exponential growth, e-commerce is becoming an essential part of life. iPrice conducts a study every three (3) to five (5) years in order to understand the evolution of the region’s online shopping habits.

In their most recent study, – “The State of Online Shoppers in Southeast Asia 2021/22” – 125 million unique users on iPrice Group websites that support e-commerce across six key SEA markets (Philippines, Indonesia, Thailand, Vietnam, Malaysia, and Singapore), data were collected ranging from January 2021 to April 2022. Here we would see the online consumer behaviour in the Philippines and other vital markets in the SEA region. This would be able to trace the impact on online shoppers of the rapid rollout of mobile broadband networks and the continued development of smartphones.

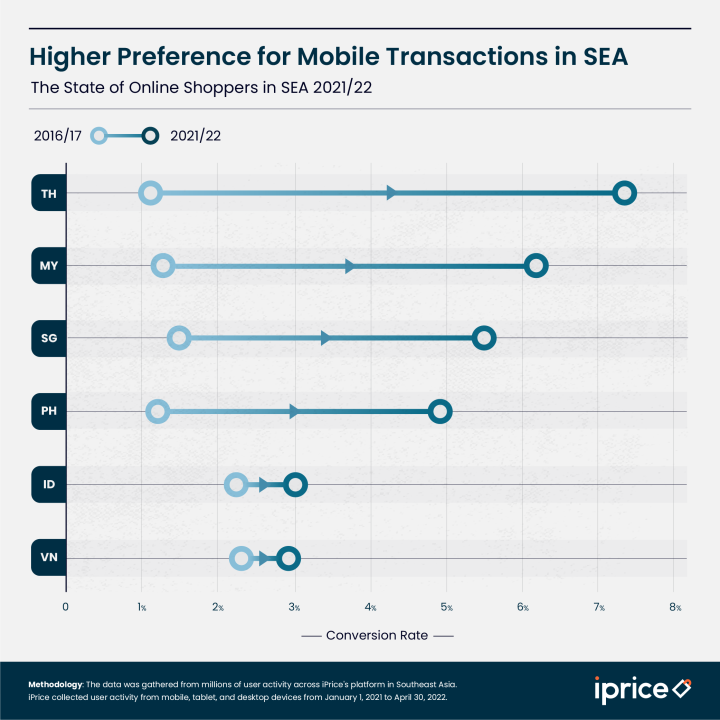

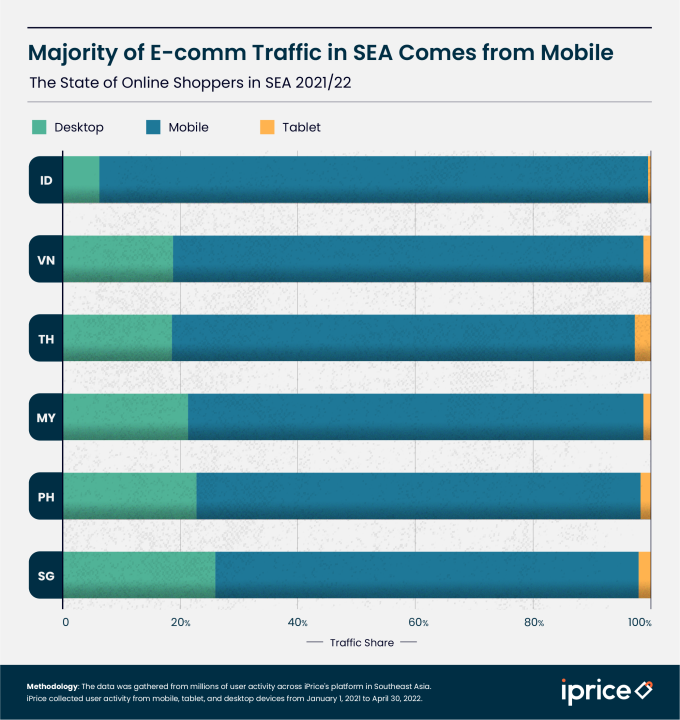

In the study, iPrice observes a high level of mobile usage with a strong preference for making a purchase via desktops in the Philippines. As opposed to five years ago, consumers are likely to set a purchase via their desktop computers rather than using their mobile devices. It sets a mark in history that times have really changed and it is seen in consumer preferences. Online shopping in the Philippines and most Southeast Asia markets have definitely shifted to smaller devices. Overall, mobile purchases in Southeast Asia are almost twice as high compared to those on desktops. 5 per cent of visitors to iPrice websites via a mobile device end in a transaction as opposed to 3 per cent of visitors using a desktop.

Vietnam is one of the markets that is an exception to this trend as consumers browse heavily on mobile but would still prefer a purchase on desktops. According to the hypothesis of iPrice, there is an underdeveloped mobile platform in the region that explains this behavior. Wherein most Vietnamese online shoppers appear to be actively browsing during working hours and would more than likely be using office desktops to complete purchases.

In comparison to other countries in Southeast Asia, the push for mobile adoption is not the same as in Vietnam.

While we see a high rise in mobile e-commerce, the desktop still plays a vital role. This is true in the Philippines, Malaysia, and Singapore where there is a high device penetration. In there particular markets, online shoppers portray hybrid browsing and buying patterns that move across multiple platforms as they transition through the purchase funnel – Awareness, Research, Decision to Purchase.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020