Filipinos going cashless are on the rise, and so are the number of mobile wallet apps that offer convenience at a few smartphone taps. We take a look at some of the readily available virtual wallets you can download and use today.

No one wants to go out without cash, and sometimes these mobile wallets save us from the hassle of bringing too much in our carriage. As more merchants support these, it’s time to actually have one or two of these in your phone. In this article, we’re defining mobile wallet apps as those that can be used to transact in real-world scenarios such as offline stores or transportation modes. Our entries are listed in alphabetical order.

Table of Contents

7-Eleven has their own app for Android and iOS called Cliqq, and it’s a good app for a number of reasons. Aside from carrying a virtual rewards card that earns points for each purchase made with any of their 2000 locations, the Cliqq app also lets you create transactions you normally would do with their in-store machines such as paying for bills and prepaid load, using their WiFi service and availing rewards items. It also features a digital wallet that lets you pay for items just by letting the store scan your in-app barcode, and even convert your reward points to in-store currency.

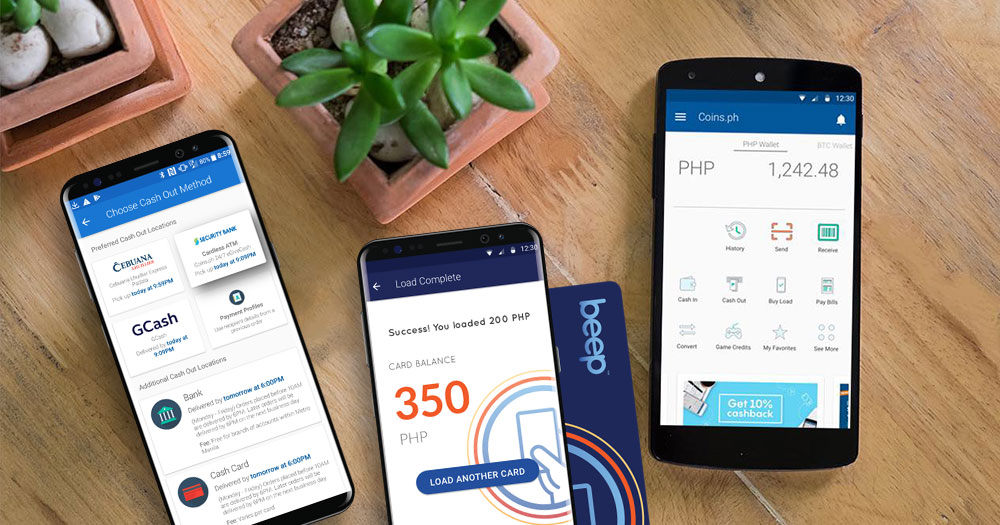

Known first as a cryptocurrency wallet, Coins.PH has evolved from just holding your digital currencies to paying your bills, paying via QR scan, reloading your phones, and even your beep cards. The Coins.ph app, so far, is the only accredited app to scan and reload beep cards that can be used in transportation and select merchants.

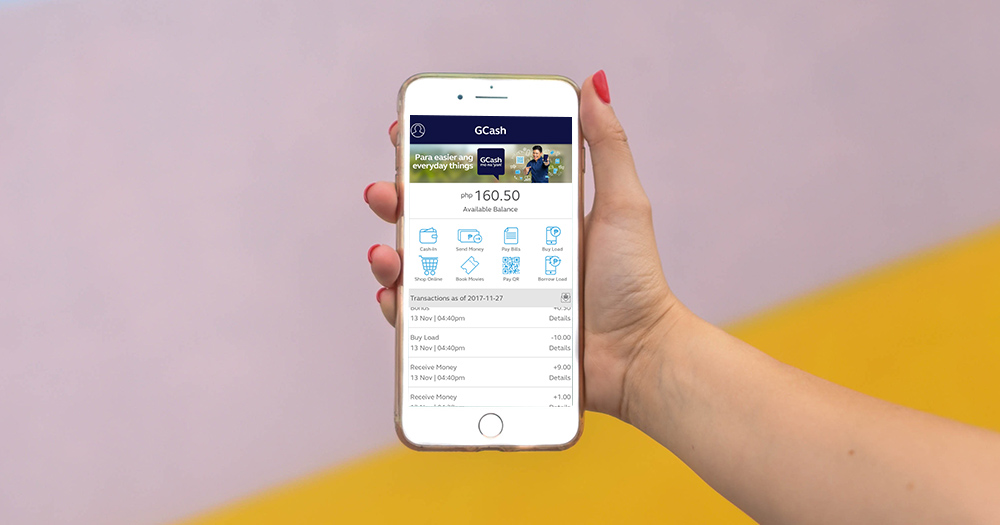

Globe’s FinTech arm Mynt has successfully transformed GCash from a simple money-sending facility in the 2000s to a more sophisticated service that added bills payment, QR payment at supported merchants, and even reloading your prepaid numbers into its growing list of in-app features. New features such as GCredit, its instant loan service, and an investment platform are also being built in.

It also recently made its app service available to all networks and is currently making adjustments to make it compatible with Ant Financial’s AliPay.

Lastly, the PLDT group’s Voyager subsidiary is betting on Paymaya as its next big thing in the industry. Similar to Globe, it has bills payment, QR scan-to-pay, and transfer facilities from one Paymaya account to another. Its differentiating factor is that you’d instantly get a virtual card that you can use on online facilities once you register, and opting into KYC (know your customer) process gives you more control as well as larger limits.

With the proliferation of smartphones in the Philippines, the financial industry is now turning into mobile-based digital wallet apps as a solution for a more convenient way of life. Which ones have you used lately? Let us know in the comments section below.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

bern says:

GCash all the way, I started enjoying this mobile wallet when they offered American Express Debit card with US address and my-shoppingbox service, if I was not mistaken Lazada was no yet existence that time. Since then, I have used a lot of this service, and had bought a whole lot of items from Amazon in those years that peso against the US dollar was still around 40pesos, even until now I still use the convenience they provide to buy digital contents I love from Amazon, that made me to amass a whole lot of Kindle books and musics, and not to mention because of my loyalty, they gave me a credit line with GCredit which I love to use to shop for groceries and on department stores.

Furthermore, GCash always offer discounts, refunds, or cash back, that paved a way to convince me to shop more locally, in particular from Lazada.

Anon for obvious reasons says:

Wow i use all of these. Some thoughts

GCASH – Most used one. Discounts and freebies galore. EAsy to use and most stores in malls in my area use it(Antipolo). (Still has some issues with some promos but NOT the big ones)

Paymaya – Same as GCASH BUT some of the sale is not as good. Still its the simplest to get a virtual credit card. (Still has some issues with some promos and sometimes its the big ones)

Coins – used mainly for cryptocurrency BUT also has decent sales AND the actual implimentation of buying and selling and using as a wallet is decent. NOTE: You do not even need to use the cryptocurrency part of the website\app. It has a PESO wallet if you will which functions as good as GCASH ( No issues with promos since its nearly instantaneous which is the power of blockchain despite the current downtrend in price)

Cliqq – I have been a 7/11 user for years with its reward cards but has not really used CLIQQ until i won 1000PHP in one of its promos. I have not used the wallet side yet but the CLIQQ catalog is one i have used. it is basically a mini-Lazada or Shopee. BUT there is one area where LAZADA AND SHOPEE PROBABLY CANNOT OUTDO IT. Unwanted product openings of family members. Both of the top online stores will always deliver to your home. The timing is also inaccurate. CLIQQ has no such issues since it will only be picked up by the USER. This is quite good for “Sexual Wellness” products you always wanted to try but hard to feel safe to be delivered to your home

Jairuz says:

Sanalajsue