We may have not realized it, but decentralized finance (DeFi) is historically not a new phenomenon. It might even be as ancient as civilization itself, for centralization of financial systems did not become a global trend until the 19th century. For one, the Philippines had not established its own central bank until 1949. However, new financial technology (FinTech) have reformed the principles of decentralized finance to the point of an apparent renaissance.

Essentially, DeFi relies on the concept of having no intermediary institution in transactions. Paired with today’s blockchain technology, it is made possible to exchange assets between people in a matter of seconds sans additional charges that could have otherwise been deducted in centralized financial systems. This is where non-fungible tokens (NFTs) enter the scene. Fungibility is the capacity of something to be exchanged for an equivalent value. Take for example how twenty 1-peso coins can be exchanged for one 20-peso coin without losing value in the transaction.

A number of cryptocurrencies like Bitcoin and Ether also operate through the same principles. For instance, a Bitcoin can be exchanged for another Bitcoin, and they will still have the same value. NFTs, on the other hand, are regarded as unique digital assets with exclusive ownerships. Seen as similar to collector’s items (e.g., art, music, videos, or even tweets), they have different values regardless of how similar other reproductions may look. This also distinguishes NFTs from interchangeable cryptocurrencies, even if they use similar technologies in the first place.

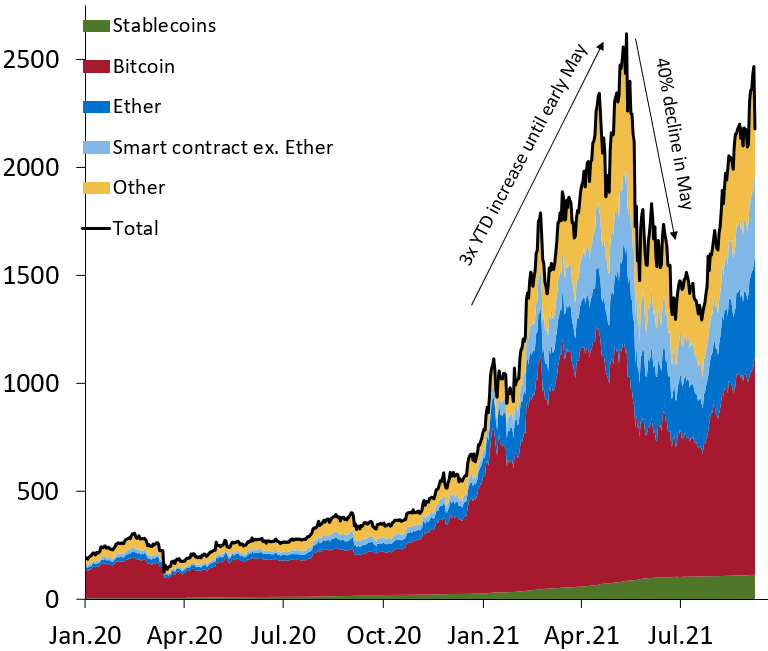

DeFi, meanwhile, provides a platform for NFT value to be operationalized. DeFi wallets such as Coinbase and Metamask serve as bridges for NFTs to access the commercial market. Also, NFT-based games and programs like Axie Infinity have skyrocketed to mainstream popularity. Indeed, the Philippines has been caught in it. The Bangko Sentral ng Pilipinas (BSP) has reported that cryptocurrency transactions amounted to over PHP 105USD 2INR 152EUR 2CNY 13 billion in the first half of 2021, an increase of 71 percent on an annual basis. In relation to this, a previous article here on buying NFTs drew quite a lot of attention, and we can understand why. Every novel technology may be subject to scrutiny as no system is truly perfect. In this discussion, we will explore the advantages and disadvantages of investing in NFTs.

As a disclaimer, the following is intended for academic and educational purposes only, written based on available information at the time of publication. This is not meant to be investment advice, nor is it attempting to promote any side of the developing data unit. Ultimately, it is within the readers’ discretion on how to take the following points of contention, and to do their own research for further studies.

Crypto and equity markets: More connected than we think?

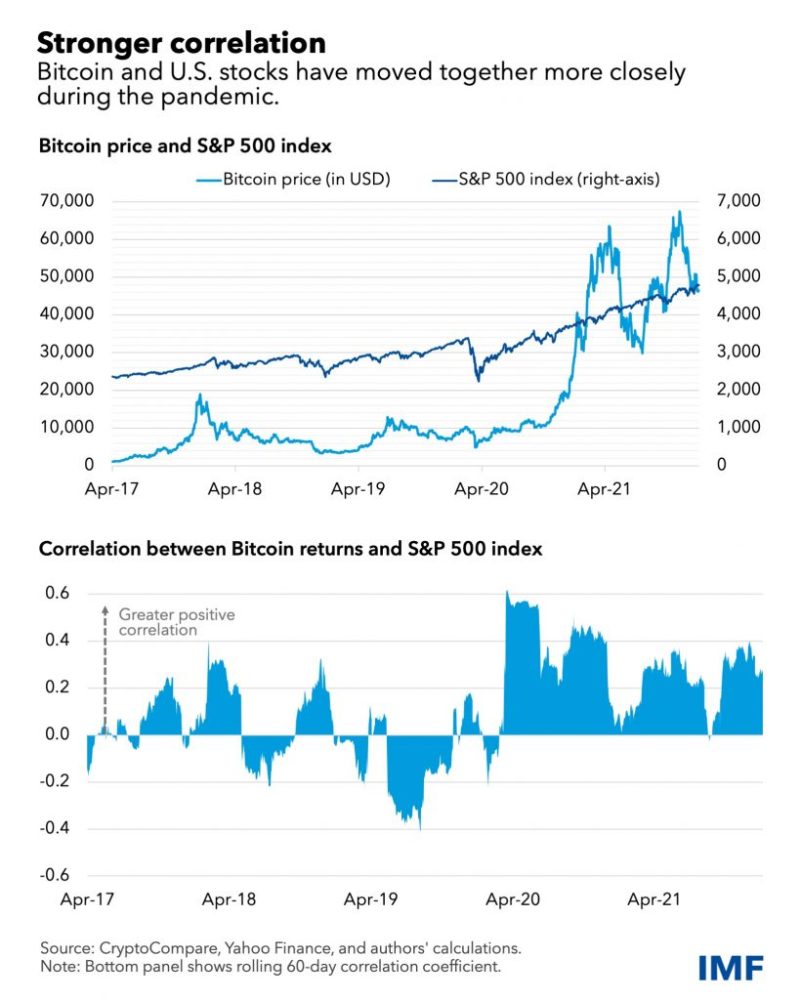

Some might like to think that NFT and related cryptocurrencies operate in a sort of new world order where centralized finance posed little to negligible effects. New research from the International Monetary Fund (IMF) seems to suggest otherwise. In January 2022, the financial institution observed how the correlation between Bitcoin and the S&P 500 index in the United States went up to 0.36 in the 2020-21 period from 0.01 in 2017-18. A similar trend could be noted elsewhere. MSCI emerging markets index, which included the Philippines, saw a correlation of 0.34 in the same time period. Of course, the highest possible correlation coefficient would be 1.

While most NFTs would likely have used Ether, it has not been immune either. Bloomberg reported that as of last February, Ether has a correlation of 0.65 with the S&P 500 index in the past 40 days, the highest since 2020.

While touted to be more efficient and interoperable, the increased risk of decentralized finance lies on its greater volatility and inherent weakness in terms of regulatory governance. With a bankless setup, there is usually no physical office to complain to when things go awry. After all, most of it is in digital form. As some crypto experts may put it, security is not on top of the agenda, but the dynamic change on methodologies of value distribution. In their defense, they will perhaps cite that even the most secure financial institution or server can be compromised by determined attacks. Then again, one has to weigh therefore if it would be worth the risk for one’s limited resources.

In addition, government’s financial instruments cannot be expected to intervene as much as they would with stock markets, for instance. At this juncture, proponents may argue that NFT should be regarded in the early stages of development because regulation usually trail behind technology. Thus, new entrants might still be able to hope getting higher revenues and a better share of the industry growth when early adopters of older innovations reap less rewards in the long run. In turn, this optimism supposedly dissolves the belief of detractors that it is a modern Ponzi scheme, a kind of fraud named after Charles Ponzi which paid early investors with money from new investments. Time was one of the enemies of such schemes. Ponzi was able to keep up his ruse for 8 months, while a modified investment scheme implemented later on by Bernard Madoff lasted well over a decade. We have yet to see how long NFTs and cryptocurrencies would operate, or if they would be able to take over the financial world anytime soon, but if it qualifies as a Ponzi scheme may be up for interpretation. There are ample arguments from all sides on this issue.

Nonetheless, with the fundamental movements of DeFi markets seemingly going along with centralized ones, it might produce additional strain to global financial stability and consumer protection. El Salvador, which adopted Bitcoin as legal tender and announced the creation of an NFT-based casino, recently received lower economic growth forecasts for 2022. From 10 percent in 2021, IMF placed its 2022 forecast to 3.2 percent, while the World Bank 4 percent. Fitch Ratings downgraded its sovereign rating from B- (highly speculative) to CCC (substantial credit risk).

While some would argue that it may take some time before El Salvador’s fiscal strategy reaps benefits, one cannot discount the possibility that it might also turn for the worse instead. Despite Bitcoin’s gains in the past few weeks, partly attributed to the conflict between Russia and Ukraine where cryptocurrencies have taken the mainstream in transactions, the 6-month trend for the cryptocurrency is downward. It has lost around 21 percent of its value during this time period. Ether is experiencing a similar trend, losing nearly 30 percent of its value in the past six months. Compare this level of volatility with the 6 percent growth in the US Dollar Index during the same period.

Imagine losing half the value of your NFT even before you get to cash it out. On another side of the story, fiat currencies could prove more volatile than existing cryptocurrencies. Note how the Turkish lira, facing double-digit inflation rates, reportedly had a 65 percent 90-day volatility last January, higher than Bitcoin. Still, if you would see the need to cash out, the likely premise is that centralized finance systems should be working smoothly as well. DeFi’s own attractiveness as an alternative system disrupts the established institutions which are trying to adopt it. Whether it is by design or by circumstance, the decoupling of DeFi systems seem to have not been as complete, and making them compatible enough with centralized financial systems had not been as smoothly implemented either.

Hypertokenization: A return to barter trade?

In historical terms, barter supposedly preceded monetary systems. It basically involves direct, and usually immediate, exchange of goods and services. However, among the criticisms for barter trade is the lack of standardized structure. For instance, a limited resource such as land or silver can be traded for a renewable one like clothing or tulips. Then again, if such a resource is scarce in an area, the perceived value of what might be a normal item elsewhere would more likely than not be skewed. Likewise, the process behind product creation can be misjudged just as well. An artwork years in the making can be traded with a piece of paper saying “The Very Best Drawing in All of Time.” It is not likely to involve an apples for apples comparison, for logic would ask why barter for something you already have. In the same way, even if they are essentially different, who is to say that one apple is superior to another apple?

Another would be the possibility of two or more parties being interested in the same indivisible item. Unless there is mutual desire and leveled expectations for an exchange, the end result might be there would be no trade at all. The problem might be less relevant in divisible items. For example, you can cut cloth into a number of pieces and still be a usable item, but how about a smartphone or a car? Can you hope to operate half a phone or drive half a car?

Nonetheless, the decentralization of finance through digital means can be regarded as a return to this kind of trade, where money and cryptocurrencies could disappear altogether while NFTs would dominate the market. However, the potential implication would be that everything would have to be tokenized, even basic commodities such as rice and salt. Taking something with a grain of salt might well have a whole new meaning in this context. Kidding aside, a 2021 study by The Wharton School of Business cautions about DeFi’s fast-growing pace. Not only can bad actors utilize DeFi systems to perpetrate terrorism and crimes, unnecessary hype could distort people’s expectations about its rewards. It is only typical for rising “sunshine” industries to provide high yields to their early believers. In turn, the promised long-term financial inclusivity might collapse in the face of attempting to optimize short-term returns. In addition, covert centralization of power within the system could disenfranchise smaller players. Futurist Alvin Toffler would probably count them as among the faceless “technicians of power” in charge of investment allocations. When trustworthiness in the system deteriorates, it might not have the sufficiency to fulfill all of its prospects.

In a more radical sense, moral questions may also abound. As currency-based systems have asked for the longest time if a human life can be statistically valued, a similar situation might be encountered later on by DeFi proponents. For instance, how much would a person be compensated for a day’s work based on NFTs? Would salt be adequate payment for services rendered? Or would there be no need to work at all in this future? It might not be as difficult to imagine now, since NFTs can still be valued in terms of fiat currencies, but what if DeFi eventually dominates?

Protection may also emerge as a point of concern. Redefining consumer protection is one thing, but producers also have their own worries. For instance, a number of artists have been disillusioned by the prospects of NFTs giving them greater control over their work and earning more in the process. NFT database NonFungible placed the 7-day average of an NFT sale at USD 1,875PHP 110,035INR 158,906EUR 1,786CNY 13,647 (approximately PHP 97,400USD 1,660INR 140,704EUR 1,581CNY 12,087), with NFT art selling at a lower average (USD 1,469PHP 86,209INR 124,497EUR 1,399CNY 10,692). A far cry from the USD 69PHP 4,049INR 5,848EUR 66CNY 502 million sale by graphic designer Mike Winkelmann, also known as Beeple. Also, ownership may be exclusive when it comes to NFT creations, but copyright would be another matter. Since NFT art are primarily digital, theft and proliferation of tokenized copies would be a potential issue moving forward.

Sourcing energy: the weaker link of NFT?

Since the foundations of NFT lay on the digital world, the next fundamental issue would be how to sustain these repositories. Electricity, of course, is what they need. Much has been said about the environmental impacts of keeping NFTs alive and valuable. Nations such as Kazakhstan, which accounted for 18 percent of the global hashrate as of August 2021, would attribute blackouts to cryptocurrency mining. Hashrate refers to the computing power needed to process transactions. In this case, the requirement to process cryptocurrency transactions.

At least one study published in Consilience puts Bitcoin consumption at 0.61 percent of global energy consumption, 39 percent of which is sourced from renewable energy sources. Then again, the same study also mentions how energy used in Bitcoin mining is around as much as that used by gold mining. In connection to this, an art studio claimed that the electricity used in a single transaction of minting NFTs (50 kilowatt-hours) is equivalent to the 2-day consumption of a large house. Or if you are living in the Philippines, that would probably amount to a typical household’s electricity consumption for around 20 days.

Beyond renewable sources, global energy production still involves the use of fossil fuels, which share is still at around 80 percent according to Our World in Data. Thus, increased energy demands would result to larger carbon footprint. Proponents would like to argue that NFTs can reduce their energy consumption in time. One of the potential solutions is the move from proof-of-work (PoW) to proof-of-stake (PoS), which would substitute staking for computer mining. That is, a built-in consensus mechanism that is used by a cryptocurrency’s network or validators.

The shift, however, might counter against the drive towards decentralization. Critics are concerned about how PoS would likely favor entities with larger amounts of tokens, leading to higher share in the benefits and greater influence in the blockchain process. While some may believe that PoS could be modified to prevent such concentration to happen, research and assessment on actual energy consumption of different PoS systems continue to this day.

On the other hand, in the unlikely event when the world goes dark and electricity production is unable to keep up, how would NFTs be operationalized? The Economist in 2021 have presented the possible correlation between cryptocurrency mining and the global chip shortage, a reality which has hampered tech growth to this day. What can assure people that a blackout situation like that in Kazakhstan would not happen in the power grid near you?

Conclusion

Is NFT a leap towards the future, or a modern recreation of the past? Globalization and digital technology has contributed to the massive adoption of NFT and related cryptocurrencies across nations, yet trust and acceptance for anything new is probably something that cannot be accelerated in human psychology. With uncertainties and risks involved, it is difficult not to err on the side of caution. Some experts would even advise to invest 5 percent or less of one’s portfolio, if one has anything to invest at all. Take your vision of the future and visualize if DeFi and NFT would be a valuable part of your planning. On the other side of the financial spectrum, there is diversity of prospective investments among established institutions which could contribute in such strategic planning. Hopefully, this concise article helped in making NFTs more understandable.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020