To date, some 200 of them have been formed in more or less 50 nations around the world. They call it “sovereign wealth fund.” Or in local parlance, as proposed by House Bill No. 6398, it would be the “Maharlika Investments Fund.”

Filed last November 28 by six representatives to help “achieving single-digit poverty levels and upper middle-income status for Filipinos,” the proposal has hurdled the House Committee on Banks and Financial Intermediaries as of December 1. House approval, meanwhile, is aimed before the adjournment of Congress this month. Then again, what do we know about this Fund being introduced in the Philippines? And for that matter, would it have effects to technology and innovation moving forward? These and more in the following FAQs.

Table of Contents

Sovereign wealth funds (SWFs) are essentially government-backed entities which invest foreign currency reserves, typically implemented by nations with sufficient fiscal space and resilience.

Created in 1953 as the Kuwait Investment Board, the Kuwait Investment Authority (KIA) is regarded as the longest standing sovereign wealth fund in the world. Statistics wise, up to 51 percent of SWF capital all over the world today were derived from commodity revenues (e.g., sale of oil and minerals). These were intended to improve returns, as well as protect, to an extent, from fluctuations in commodity prices. In a more specific sense, SWFs would usually exclude foreign reserves intended for traditional balance of payment (BOP) or monetary policy purposes, state-owned enterprises, government-employee pension funds, and/or assets managed by individuals, among others.

Although public pension funds may share similarities with SWFs, there are distinctions between them which the likes of the Organisation for Economic Cooperation and Development (OECD) would like to point out. For one, public pension funds are meant to serve as long-term financing vehicle for pay-as-you-go pension plans.

In 2008, the Santiago Principles (called as such for being agreed upon at Santiago, Chile) have been drafted to “identify a framework of generally accepted principles and practices that properly reflect appropriate governance and accountability arrangements as well as the conduct of investment practices by SWFs on a prudent and sound basis.” Thirty (30) members of the International Forum of Sovereign Wealth Funds (IFSWF) endorse the Santiago Principles. Adherence to these aforementioned principles was also cited by the House bill in its pledge to ensure accountability and transparency for the proposed independent fund (that is, the MIF).

Depending on their respective investment mandate, SWFs may fall in any one of the following categories, or could perform a combination of these purposes:

Three of the largest SWFs in the world, meanwhile, would be the following:

The House bill, for its part, explains that investment would be meant for stabilizing the national budget, create savings for citizens, or promoting economic development. In particular, the following objectives were laid out:

The six representatives who introduced the bill were as follows: House Speaker Ferdinand Martin G. Romualdez, House Majority Leader Manuel Jose “Mannix” M. Dalipe, Senior Deputy Majority Leader Ferdinand Alexander “Sandro” A. Marcos, Marikina City Representative Stella Luz A. Quimbo, as well as Tingog Party-list Representatives Yedda Marie K. Romualdez and Jude A. Acidre.

This was not the first time such a measure had been proposed in the Philippine Congress, but thus far it had met better success with its legislative track. For instance, two proposals to create a Philippine Sovereign Wealth Fund were made in the Senate by Former Senator Paolo Benigno “Bam” Aquino (October 19, 2016), and Senator Joseph Victor “JV” Ejercito (March 21, 2018) during the 17th Congress. Neither went beyond the committee level. However, it might well be the first time in recent legislative history that such a proposed fund would bear the “Maharlika” name.

Legal ownership of the MIF shall pertain to the Fund investors in proportion to their shareholdings. The bill specified the following financing sources to constitute the initial investment of PHP 250 billion:

These were intended to be sourced from investible funds of the aforementioned institutions. The national government (NG) shall also contribute an initial PHP 25 billion, and may contribute additional funds on an annual basis provided funds for the purpose are available. GSIS registered over PHP 1.5 trillion in total assets as of 2021, while SSS reported over 702.4 billion in total assets also during the same period (2021). LANDBANK and DBP are among the largest banks in the country, having PHP 2.8 trillion and PHP 971 billion in total assets, respectively. Proponents of the measure had assured these would have no negative impact on the social services provided by the aforementioned government financial institutions (GFIs).

Subsequently, annual contributions shall be provided from the following:

To give a better perspective on the size of the cited contributions, OFW remittances amounted to a total of USD 34.884 billion (over PHP 1.9 trillion) for the entirety of 2021 according to BSP, while the IT and Business Process Association of the Philippines (IBPAP) recorded USD 29.49 billion (over PHP 1.6 trillion) in BPO revenues also for the year 2021. PAGCOR, for its part, reported PHP 26.70 billion in total income during the first half of 2022.

The following investments are allowed by the proposed measure:

Not more than 10 percent of the gross revenue of the immediately preceding year shall be used for administrative and operational expenses of the Maharlika Investments Corporation (MIC). MIF investment activities shall be reported to the President of the Philippines not later than seven (7) days after each quarter, and submit financial statements not later than seven (7) days after each month.

The MIF and the MIC shall be exempt from any and all forms and kinds of direct or indirect taxes. In addition, distribution of net profits would be exempted from the provisions of the Dividends Law (Republic Act No. 7656).

The MIC Board of Directors would be composed of nine members, namely the Finance Secretary as representative of the national government, two independent directors, and six members from the founding government financial institutions (GFIs) which membership seats are allocated based on the proportion of their investments. To recall, the founding GFIs would be the GSIS, SSS, LANDBANK, and DBP. With a term of seven (7) years, the Chairperson and Chief Executive Officer (CEO) shall be derived from the founding GFI member with the largest fund investment.

Three regular board members would have five-year terms, while the other three members would have three-year terms. Ultimately, the independent directors would have one-year terms. The primary function of the Board of Directors is to govern and manage the MIF, its assets, and investments. It is mandated to meet once every month, and may hold special meetings to consider urgent matters upon call of the Chairperson and CEO, or upon initiative of at least two (2) members of the Board of Directors.

To assist the Board, an Advisory Body constituted by the Finance Secretary, Budget Secretary, Socioeconomic Planning Secretary, and Treasurer of the Philippines would be formed. However, they are not to take part in the control or management of the MIF.

Three layers of audit would be conducted to accomplish the financial reporting framework of the MIF.

A fourth layer of audit was also cited by proponents, although not explicitly worded in the bill itself, particularly coming from the risk committees of the involved GFIs.

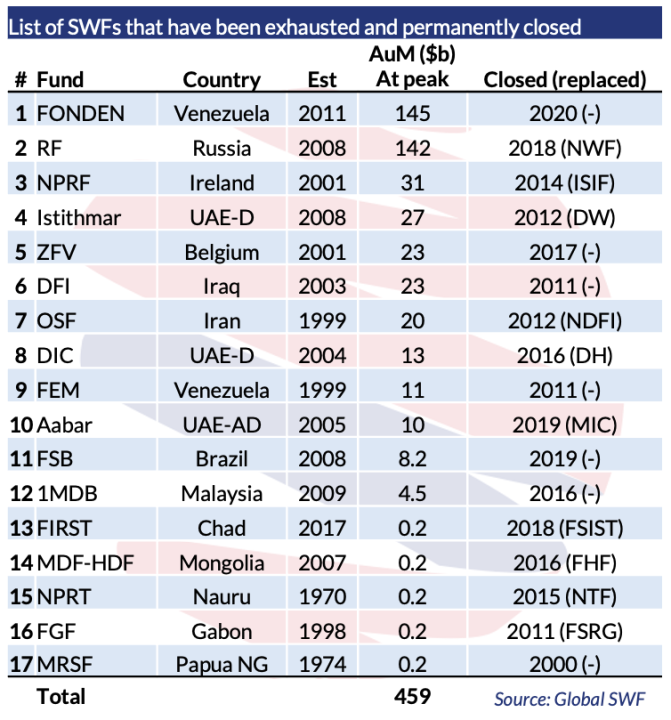

Despite having a record-breaking year in 2021, the issue of adequate safeguards has long permeated the debate regarding SWFs, particularly poorly-administered ones such as the 1Malaysia Development Berhad (1MDB). An International Monetary Fund (IMF) Working Paper in 2013 had identified three similar layers of governing bodies which are typically included in a well-governed SWF in addition to their own compliance unit. These are as follows:

In fact, another IMF Working Paper had noted in 2008 how although all of the SWFs they surveyed had internal audit arrangements, “few SWFs have their accounts audited by Auditor Generals, another independent government agency, or the Ministry of Finance itself.” While the Santiago Principles have provided for an audit (GAPP 12), a 2008 policy brief from Peterson Institute for International Economics (PIIE) on best practices saw how 62 percent of surveyed non-pension SWFs had done their audit, with a lower proportion of 32 percent having them published.

Believe it or not, SWFs have become a major factor in technology and innovation investing globally. For instance, the USD 284-billion Mubadala Investment Company (United Arab Emirates) is reportedly seeking out the tech sector, including Abu Dhabi’s first fully regulated carbon exchange. A similar upbeat outlook on tech is shared by NBIM.

“The industries that have gained importance are, not surprisingly, healthcare, retail and consumer, and technology. All three sectors are touched by the magic wand of Venture Capital,” said the 2022 Annual Report of Global SWF.

Of course, it remains to be seen whether the tech sector would also receive substantial blessings from the MIF, but when foreign investors to the Philippines have eyed energy and tech among other sectors for 2023, perhaps their sustained attractiveness would lessen doubts about their current investment viability. Whether or not the trend holds, however, it remains to be seen. After all, besides tech, infrastructure is seen as a field where SWFs saw opportunities to diversify their respective portfolios.

“With typically low volatility and reliable cash flows, infrastructure investments provide returns with a low correlation to other asset classes and over the last decade, many institutional investors have allocated to the asset class as a substitute for fixed income due to stubbornly low interest rates,” observed the IFSWF in its annual review.

While opponents of the measure would like to capitalize on the risks involved, as well as the potential political leverage when it comes to managing available economic resources, there is also reason to believe there are indeed SWFs worthy of our attention. For 2021, direct investments from SWFs rose by 50 percent year-on-year, and would be 60 percent higher than the previous five-year average. Despite the conditions brought by the pandemic, SWFs had not experienced large-scale withdrawals in general. The trend has also veered towards domestic investment, which implies that SWFs would more likely put their money to help develop local industries.

The proposal itself cited what it deemed to be SWF models, such as Singapore’s GIC and the Indonesia Investment Authority (INA). Would the MIF faithfully fulfill the aspirations of its supporters? Perhaps only time can tell.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

Onnies says:

Wala sigurong nakapansin pero contribution po ulit ito from OFWs and from BPO Industry at kakarampot manggagaling sa mga pasugalan, Please note na walang direktang mapapala ang mga OFWs sa panibagong contribution nato, Bakit hindi manggaling sa mga sweldo ng mga Mambabatas at Government Employees?

Bayan says:

Di Naman sya contribution ng ofw, mag lalaan lang Ang bsp ng dollar reserve nya equivalent ng 10 percent annual remittances ng mga ofw,

jr. remigio igancio says:

what worries us is the source of funds- why pension funds? why not from taxes or other sources? why not reduce the amount of govt officals allowances and intel funds? why? customs duties uncollected dues-

Docpao says:

True, why not reduce intel fund, from office of bbm and vp sarah. Use it in this project.It willmake sence.

zeg says:

OVERSIGHT is very very IMPORTANT.

SWF could be an investment vehicle to capitalise massive local infrastructures which would have otherwise be put under PPP but which naturally takes at least 25yrs before the same is owned by the government. (e.g. toll ways, bridges, water systems, solar farms, etc)

However, a short-cycle investment returns.might be the preferred focus in the next 5yrs. SWF should also be directed towards natural elements which could only be found in the Phils or rarely found in other parts of the world, but which usage is critical in the value chain for the creation of BIG BRANDS – e.g. iPhones, Tesla Cars, android phones, EVs.

The Maharlika Corp should have its own cadre of Industry Analysts to deliberate which are bankable products or services worth investing; able to foresee disruptive scenarios in their respective industries – hedging that is!

Justin says:

It’s all smoke and mirrors. Scam lang para manakaw ng mga pulitiko ang PH reserves.

Miss Call says:

Why do you need the sovereign wealth fund when in the first place all Marcos Jr had to do was release the Tallano and Yamashita gold, and force all the central banks of the world to release the Marcos wealth that they froze?

Lakas Adonil says:

Maharlika Wealth Fund is a legal framework in which the Marcos Trust Fund given to the Filipino people will be used to improved the life of the filipino.

Watchtower says:

Dahil diyan nila ibabato ang mga yaman nila na alam nila na magagamit ng bansa kaya nga pinangalanan na “MAHARLIKA” remember that only the marcoses who recognize na Maharlika ang tunay na pangalan ng Pilipinas at hindi Pilipinas na kinuha sa pangalan ng hari ng espanya. kaya nga ang national highway from north to south pinangalanan ng ama niya na MAHARLIKA HIGHWAY.

Docpao says:

Correct hahahhaha